Trafigura says aluminum’s rally has reached its limit as supplies recover. Trafigura analyst Henry Wang notes increased supply and weak demand. He also notes declining manufacturing demand outside of China.

“We’re seeing a very bleak demand picture right now,” Wang stressed at the CRU World Aluminum Conference in London. He noted that the price increase is significantly exaggerated.

Three-month aluminum futures on the London Metal Exchange have risen 8% this year, driven by overall growth in the commodities sector. Aluminum is used in a variety of industries, from solar panels to automobiles and beverage packaging.

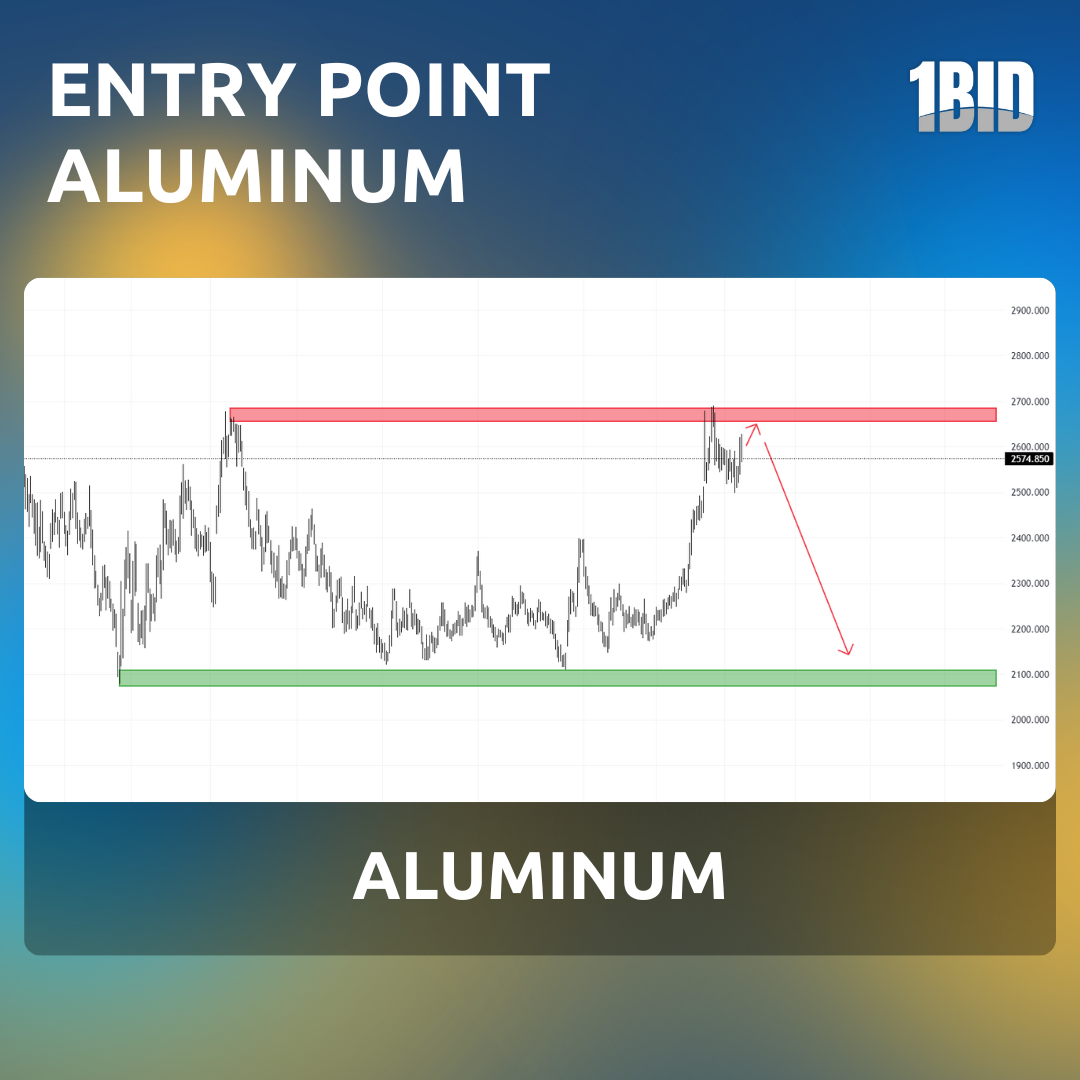

Wang predicts commodity aluminum prices will return to the previous range of $2,100 to $2,400 per ton over the next six months. This is due to lower consumption, especially outside of China.

High aluminum prices encourage smelters to resume reduced production, which in turn increases supply. Wang notes that there are a lot of plant restarts happening now, which is one of the highest rates in history.

According to Bloomberg News, Trafigura is actively supplying record aluminum supplies to the LME. Total stocks doubled in a few days to more than 1 million tons.

It is also worth remembering that the exchange rate of aluminum against the dollar may be influenced by the Fed’s plan to reduce inflation, which could lead to a devaluation of the dollar. The economic environment is currently volatile, so traders and investors need to be alert to market opportunities. If supply exceeds demand, then the price will eventually decrease. Follow the news and trade with ONEBID so you don’t miss the opportunity to make money when the commodity metals sell-off begins.