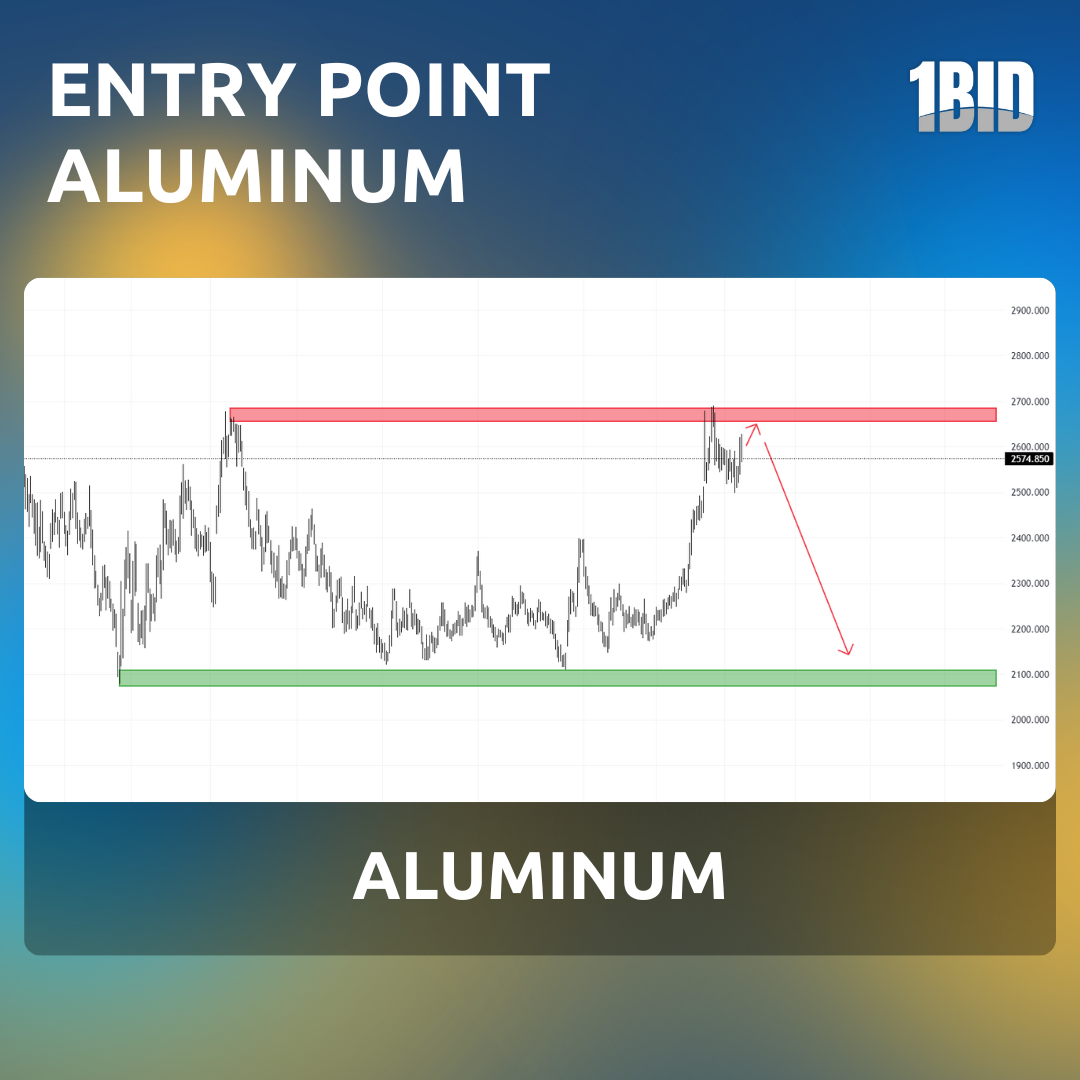

Is it a good time to buy gold or prepare for further declines?

Gold prices have experienced a significant decline following Donald Trump’s decisive victory in the recent U.S. presidential election. This outcome has led to a surge in the U.S. dollar, which reached a four-month high, and rising Treasury yields, creating downward pressure on gold. Analysts, including James Hyerczyk from FX Empire, have noted that traders are locking in profits amid these market shifts, with gold now facing a critical support test near the 50-day moving average at approximately $2,636.66. The upcoming Federal Reserve rate decision adds further uncertainty to the market.