Inflation in the EU

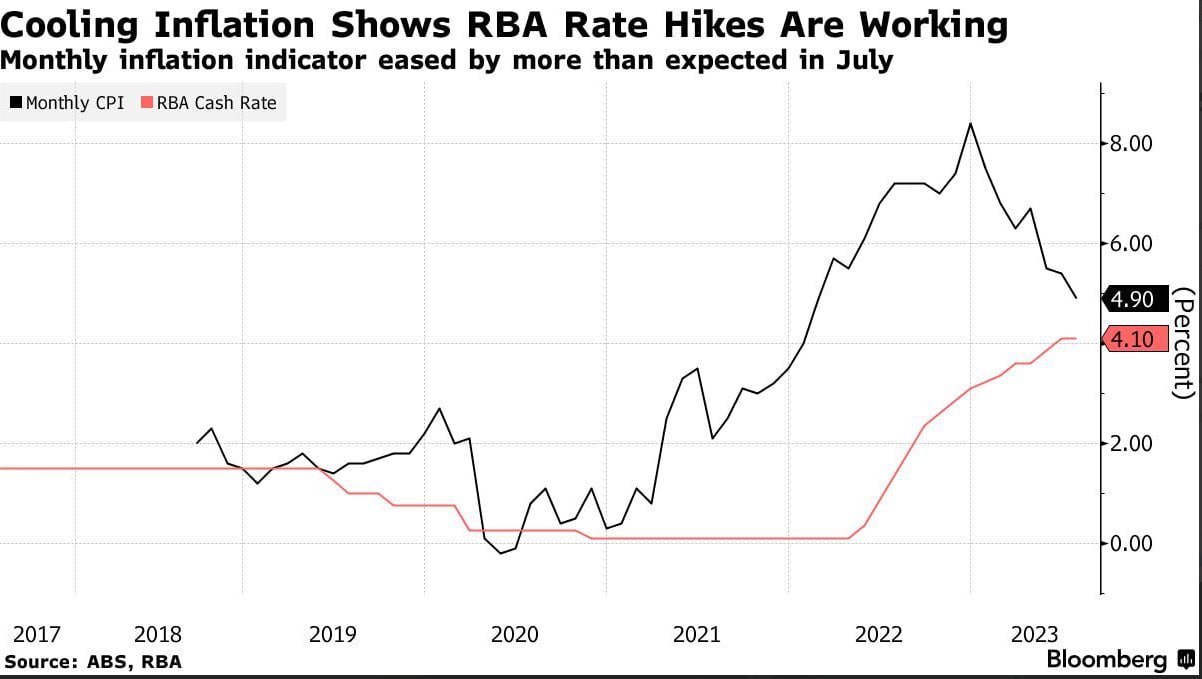

Some ECB chiefs have said the latest data for July and August point to a slowdown in the economy in Q3 and may continue to do so in Q4. In addition, they noted that the ECB is in the final stages of raising interest rates, but emphasized the need to work to bring inflation back…